Continued weakness in quarterly results

In the Q2 2024 earnings season, nearly all of the seven biggest U.S. fast food chains posted weaker than expected results. Restaurant Brands International Inc, the owner of Burger King, beat consensus estimates for overall top-line sales but missed on same-store-sales, a key metric for restaurants which measures the sales growth for stores opened for more than 13 months (Chart 2).

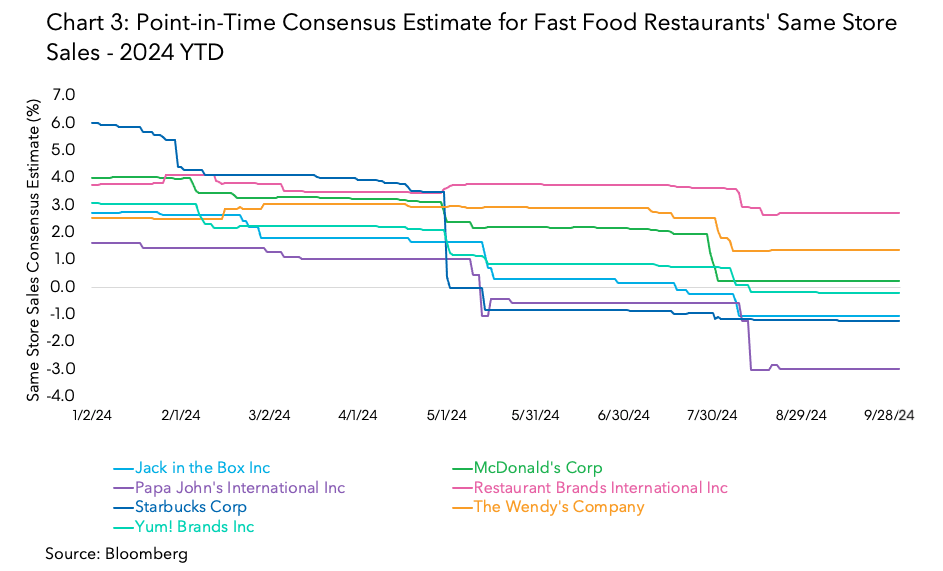

Analyzing the point-in-time consensus estimate, analysts have significantly revised downward the same-store sales outlook for all restaurants for the year 2024, with Restaurant Brands International experiencing the most substantial revision.

Using alternative data to anticipate sales surprise

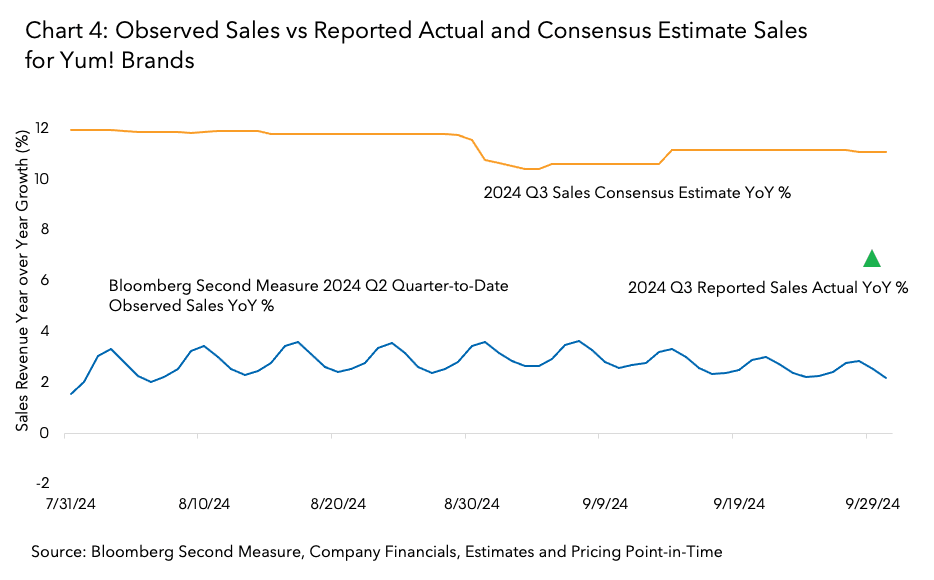

Alternative data, such as credit card transaction data, can provide intra-quarter insights on company performance ahead of earnings announcements. For example, in the case of Yum! Brands, our analysis shows a divergence between observed sales from alternative data and analysts’ consensus estimates. Chart 4 shows a consistent lower read from Bloomberg Second Measure data for Yum! Brands compared to consensus estimates for 2024 Q3, indicating that Yum! Brands could have a negative sales surprise for the quarter.

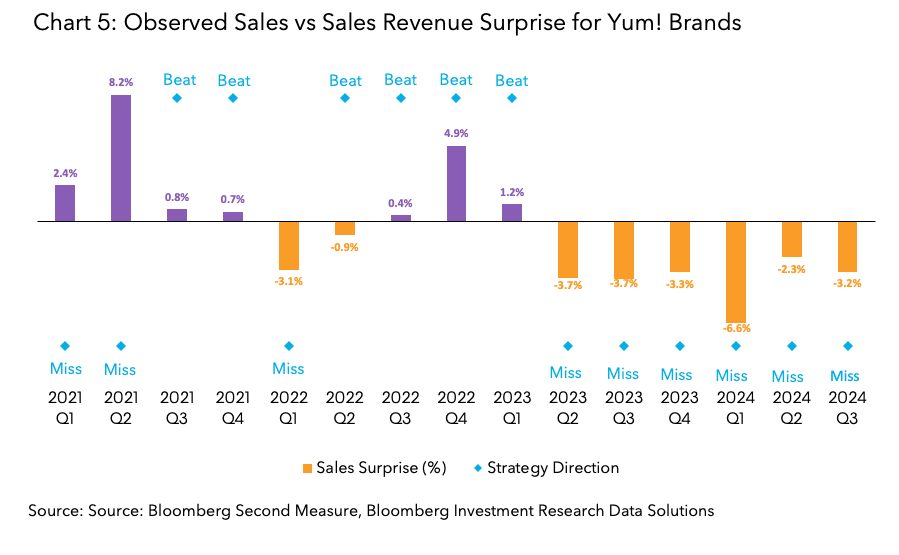

Chart 5 shows the reported earnings of the most recent 15 quarters for Yum! Brand; 80% of the time Bloomberg Second Measure pointed in the right direction, while consensus was either over or under estimating earnings.

Getting an early read on company performance

By using Bloomberg Second Measure transaction data analytics, available via Bloomberg Data License and delivered daily with a 3-day lag and via Bloomberg Terminal ALTD

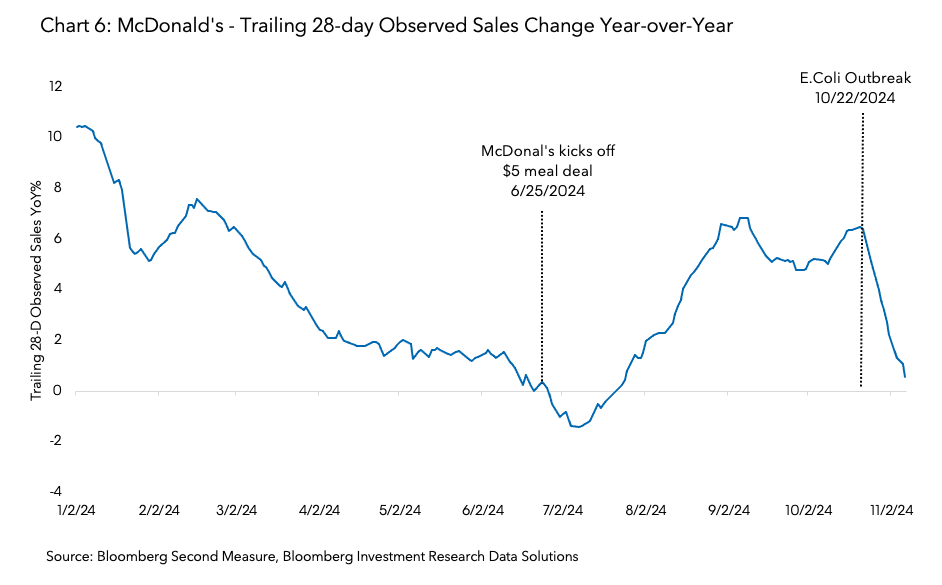

Chart 6 shows the trailing 28-day observed sales change year-over-year for McDonald’s. After the company announced the five dollar value meal to attract customers at the end of June 2024, we observed a turnaround of the observed sales.

Data solutions

Interested in deriving data-driven insights to track company performance? Bloomberg’s Investment Research Data Solutions include a suite of products such as Company Financials, Estimates and Pricing Point-in-Time and Industry Specific Company Financials and Estimates PiT products, covering a broad universe of companies and providing deep actionable insights, which seamlessly integrate with other datasets including alternative data such as Bloomberg Second Measure transaction data so clients can easily build company and industry knowledge graphs.

Bloomberg Data License provides billions of data points daily spanning Reference, ESG, Pricing, Risk, Regulation, Fundamentals, Estimates, Historical data and more to help you streamline operations and discover new investment opportunities. Data License content aligns with the data on the Bloomberg Terminal to support investment workflows consistently and at scale across your enterprise.

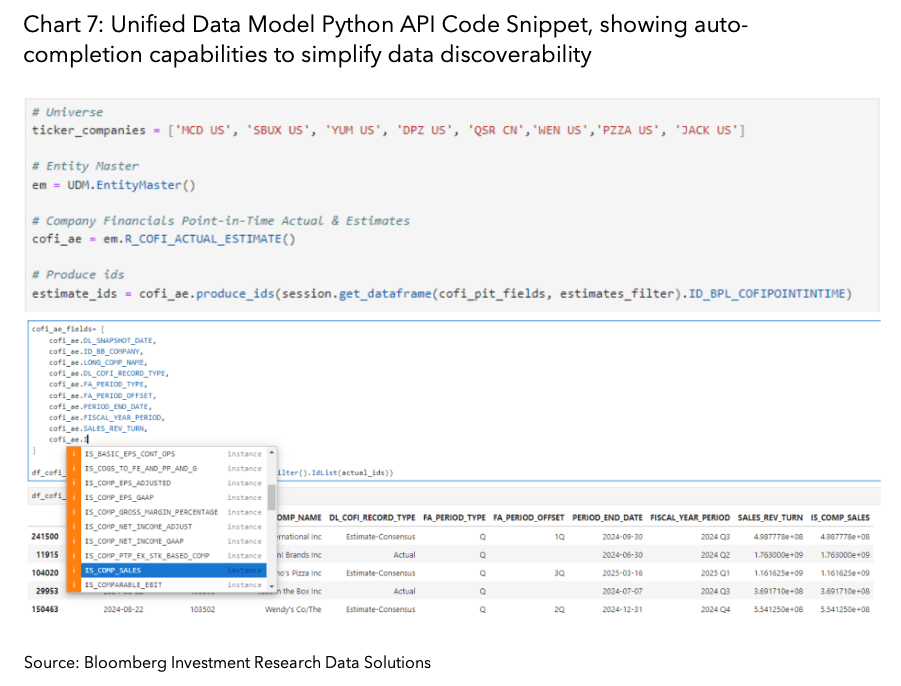

Bloomberg’s Investment Research Data Solutions also comes with a python UDM* API tool which helps to simplify data query process and wrangling. One important feature is auto-completion of fields helping researchers and data scientists with data discoverability (Chart 7).

*Unified Data Model, a Bloomberg proprietary data model helping its clients with an advanced data model to link all datasets into Entities, Instruments, Markets and Pricing.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

For each company, the predictive accuracy of Bloomberg Second Measure’s (“BBSM”) estimates will typically vary over time. BBSM does not guarantee that the accuracy levels, trends or correlations illustrated by the examples in this document will recur for any company in the future. The estimates have been generated by running a standard nonproprietary formula on analytical data about past consumer transactions. BBSM makes available information about this formula to Bloomberg Second Measure clients and the analytical data is also accessible to such clients.